Concentrated Liquidity

Background

Concentrated liquidity is a novel Automated Market Maker (AMM) design introduced by Uniswap that allows for more efficient use of capital. The improvement is achieved by providing liquidity in specific price ranges chosen by the user.

For instance, a pool with stablecoin pairs like USDC/USDT has a spot price that should always be trading near 1. As a result, Liquidity Providers (LPs) can focus their capital in a small range around 1, rather than the full range from 0 to infinity. This approach leads to an average of 200-300x higher capital efficiency. Moreover, traders benefit from lower price impact because the pool incentivizes greater depth around the current price.

Concentrated liquidity also opens up new opportunities for providing liquidity rewards to desired strategies. For example, it's possible to incentivize LPs based on their position's proximity to the current price and the time spent within that position. This design also allows for a new "range order" type, similar to a limit order with order-books.

Architecture

The traditional Balancer AMM relies on the following curve that tracks current reserves:

This formula allows for distributing liquidity along the $xy=k$ curve and across the entire price range of (0, ∞).

With the new architecture, we introduce the concept of a position that allows

users to concentrate liquidity within a fixed range. A position only needs to

maintain enough reserves to satisfy trading within this range. Consequently,

it functions as the traditional xy = k within that range.

In the new architecture, real reserves are described by the following formula:

Where P_l is the lower tick, P_u is the upper tick, and L is the amount

of liquidity provided,

This formula stems from the original $xy = k$ but with a limited range. In the

traditional design, a pool's x and y tokens are tracked directly. However,

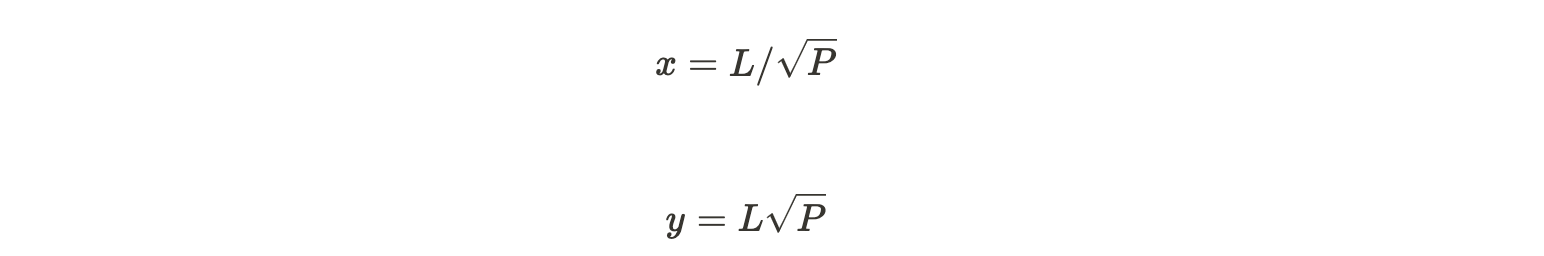

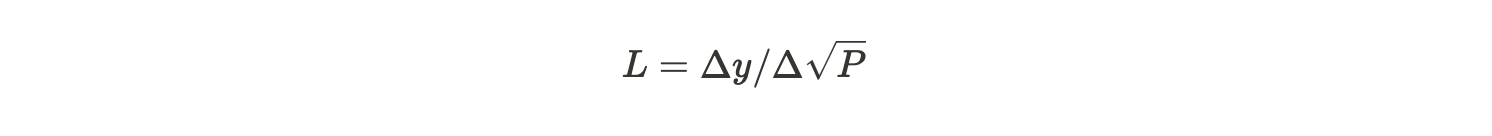

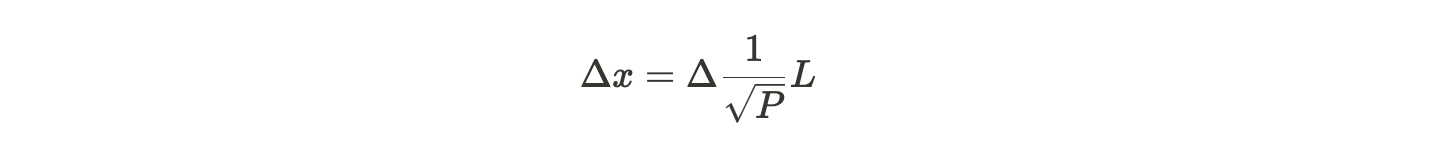

with the concentrated design, we only track $L$ and $\sqrt P$, which can be

calculated with:

By rearranging the above, we obtain the following formulas to track virtual reserves:

Note the square root around price. By tracking it this way, we can utilize the following core property of the architecture:

Since only one of the following changes at a time:

- $L$: When an LP adds or removes liquidity

- sqrt P: When a trader swaps

We can use the above relationship to calculate the outcome of swaps as well as pool joins that mint shares.

Conversely, we calculate liquidity from the other token in the pool:

Overall, the architecture's goal is to enable LPs to provide concentrated liquidity within a specific range while maintaining high capital efficiency.

Ticks

Context

In Uniswap V3, discrete points (called ticks) are used when providing liquidity in a concentrated liquidity pool.

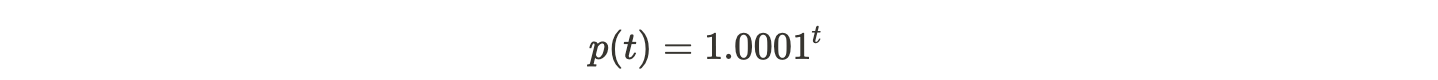

The price [p] corresponding to a tick [t] is defined by the equation:

This results in a .01% difference between adjacent tick prices. This does not, however, allow for control over the specific prices that the ticks correspond to. For example, if a user wants to make a limit order at the $17,100.50 price point, they would have to interact with either tick 97473 (corresponding to price $17,099.60) or tick 97474 (price $17101.30).

Since we know what range a pair will generally trade in, how can we provide more granularity at that range and provide a more optimal price range between ticks instead of the "one-size-fits-all" approach explained above?

Geometric Tick Spacing with Additive Ranges

In Osmosis' implementation of concentrated liquidity, we will instead make use of geometric tick spacing with additive ranges.

We start by defining an exponent for the precision factor of each incremental tick starting at the spot price of one. This is referred to as $exponentAtPriceOne$.

In the current design, we hardcode $exponentAtPriceOne$ as -6. When used with a tick spacing of 100, this effectively acts as an $exponentAtPriceOne$ of -4, since only every 100 ticks are able to be initialized.

When $exponentAtPriceOne = -6$ (and tick spacing is 100), each tick starting at 0 and ending at the first factor of 10 will represents a spot price increase of 0.0001:

- tick_{0} = 1

- tick_{100} = 1.0001

- tick_{200} = 1.0002

- tick_{300} = 1.0003

This continues until the pool reaches a spot price of 10. At this point, since the pool has increased by a factor of 10, the $exponentAtCurrentTick$ increases from -4 to -3 (decreasing the incremental precision), and the ticks will increase as follows:

- tick_{8999900} = 9.9999

- tick_{9000000} = 10.000

- tick_{9000100} = 10.001

- tick_{9000200} = 10.002

For spot prices less than a dollar, the precision factor decreases (increasing the incremental precision) at every factor of 10:

- tick_{-100} = 0.99999

- tick_{-200} = 0.99998

- tick_{-500100} = 0.94999

- tick_{-500200} = 0.94998

- tick_{-9000100} = 0.099999

- tick_{-9000200} = 0.099998

This goes on in the negative direction until it reaches a spot price of 0.000000000000000001 or in the positive direction until it reaches a spot price of 100000000000000000000000000000000000000.

The minimum spot price was chosen as this is the smallest possible number supported by the sdk.Dec type. As for the maximum spot price, the above number was based on gamm's max spot price of 340282366920938463463374607431768211455. While these numbers are not the same, the max spot price used in concentrated liquidity utilizes the same number of significant figures as gamm's max spot price and is less than gamm's max spot price which satisfies the initial design requirements.

Formulas

After we define tick spacing (which effectively defines the $exponentAtPriceOne$, since $exponentAtPriceOne$ is fixed), we can then calculate how many ticks must be crossed in order for $k$ to be incremented ( $geometricExponentIncrementDistanceInTicks$ ).

Since we define exponentAtPriceOne and utilize this as the increment starting point instead of price zero, we must multiply the result by 9 as shown above. In other words, starting at 1, it takes 9 ticks to get to the first power of 10. Then, starting at 10, it takes 9*10 ticks to get to the next power of 10, etc.

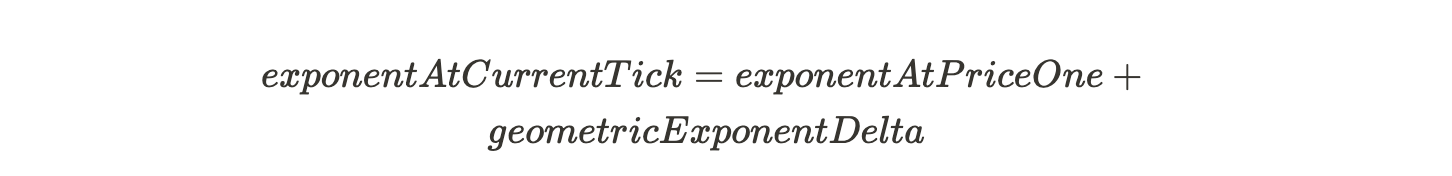

Now that we know how many ticks must be crossed in order for our exponentAtPriceOne to be incremented, we can then figure out what our change in exponentAtPriceOne will be based on what tick is being traded at:

With geometricExponentDelta and exponentAtPriceOne, we can figure out what the exponentAtPriceOne value we will be at when we reach the provided tick:

Knowing what our exponentAtCurrentTick is, we must then figure out what power of 10 this $exponentAtPriceOne$ corresponds to (by what number does the price gets incremented with each new tick):

Lastly, we must determine how many ticks above the current increment we are at:

With this, we can determine the price:

where (10^{geometricExponentDelta}) is the price after $geometricExponentDelta$ increments of exponentAtPriceOne (which is basically the number of decrements of difference in price between two adjacent ticks by the power of 10)

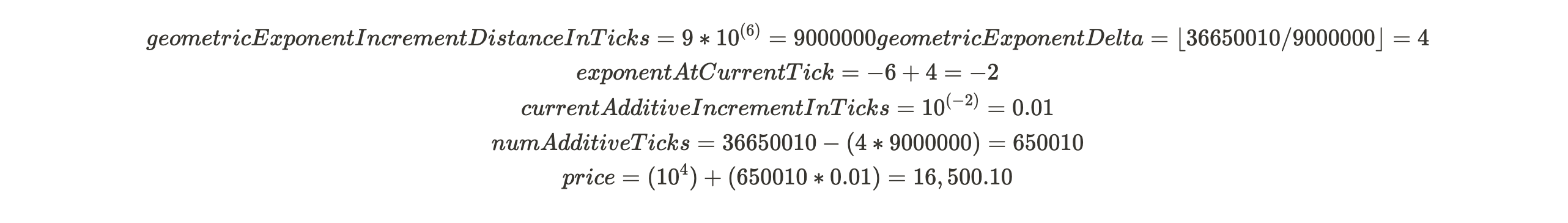

Tick Spacing Example: Tick to Price

Bob sets a limit order on the USD<>BTC pool at tick 36650010. This pool's

$exponentAtPriceOne$ is -6. What price did Bob set his limit order at?

Bob set his limit order at price $16,500.10

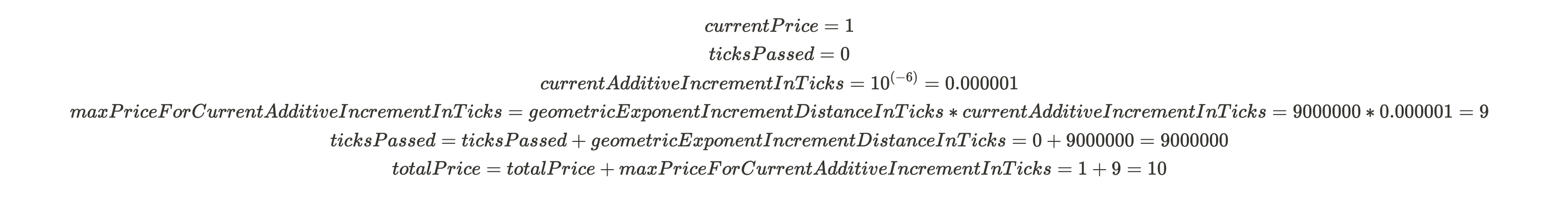

Tick Spacing Example: Price to Tick

Bob sets a limit order on the USD<>BTC pool at price $16,500.10. This pool's

$exponentAtPriceOne$ is -6. What tick did Bob set his limit order at?

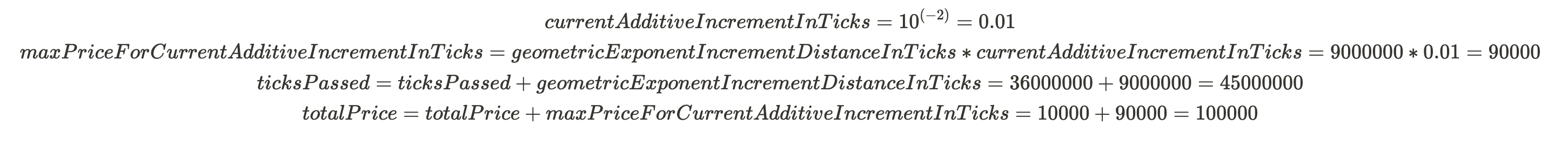

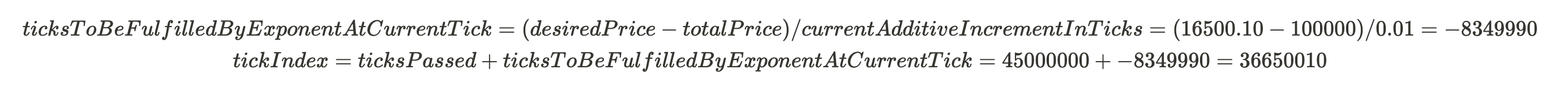

We must loop through increasing exponents until we find the first exponent that is greater than or equal to the desired price

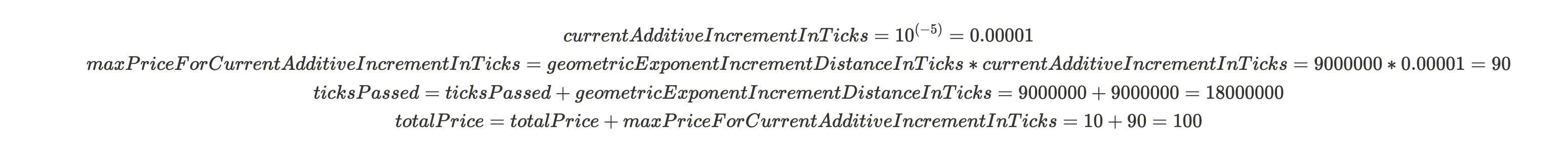

10 is less than 16,500.10, so we must increase our exponent and try again

100 is less than 16,500.10, so we must increase our exponent and try again. This goes on until...

100000 is greater than 16,500.10. This means we must now find out how many additive tick in the currentAdditiveIncrementInTicks of -2 we must pass in order to reach 16,500.10.

Bob set his limit order at tick 36650010

Chosing an Exponent At Price One Value

The creator of a pool cannot choose an exponenetAtPriceOne as one of the input parameters since it is hard coded to -6. The number can be psedo-controlled by choosing the tick spacing a pool is initialized with. For example, if a pool is desired to have an exponentAtPriceOne of -6, the pool creator can choose a tick spacing of 1. If a pool is desired to have an exponentAtPriceOne of -4, this is two factors of 10 greater than -6, so the pool creator can choose a tick spacing of 100 to achieve this level of precision.

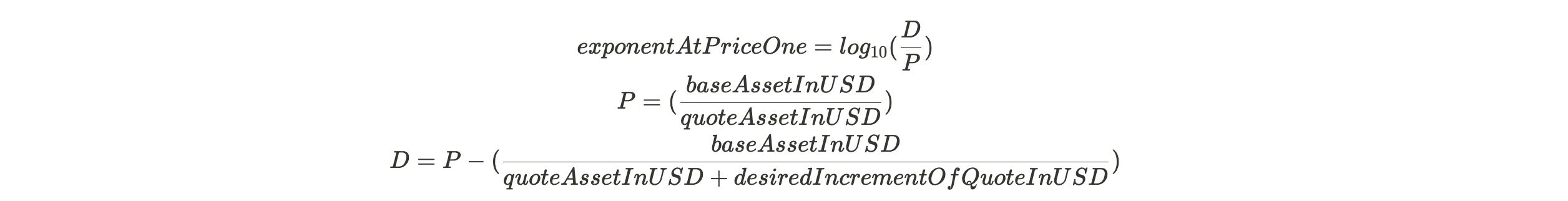

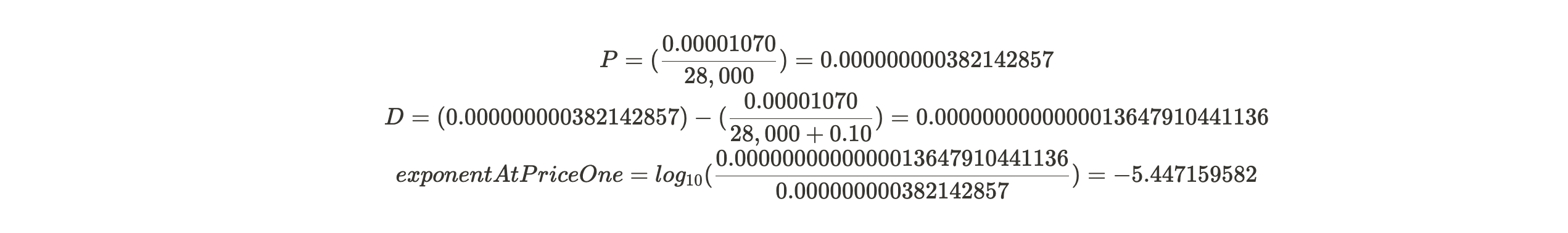

As explained previously, the exponent at price one determines how much the spot price increases or decreases when traversing ticks. The following equation will assist in selecting this value:

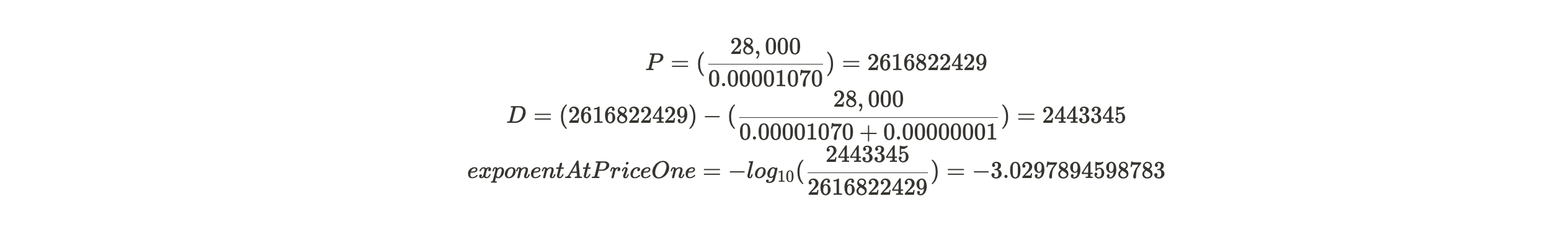

Example 1

SHIB is trading at $0.00001070 per SHIB BTC is trading at $28,000 per BTC

We want to create a SHIB/BTC concentrated liquidity pool where SHIB is the

baseAsset (asset0) and BTC is the quoteAsset (asset1). In terms of the quoteAsset,

we want to increment in 10 cent values.

We can therefore conclude that we can use an exponent at price one of -5 (slightly under precise) or -6 (slightly over precise) for this base/quote pair and desired price granularity. This means we would either want a tick spacing of 1 (to have an exponent at price one of -6) or 10 (to have an exponent at price one of -5).

Example 2

Flipping the quoteAsset/baseAsset, for BTC/SHIB, lets determine what the exponentAtPriceOne should be. For SHIB as a quote, centralized exchanges list prices at the 10^-8, so we will set our desired increment to this value.

We can therefore conclude that we can use an exponent at price one of -3 for this base/quote pair and desired price granularity. This means we would want a tick spacing of 1000 (to have an exponent at price one of -3).

Consequences

This decision allows us to define ticks at spot prices that users actually desire to trade on, rather than arbitrarily defining ticks at .01% distance between each other. This will also make integration with UX seamless, instead of either:

a) Preventing trade at a desirable spot price or b) Having the front end round the tick's actual price to the nearest human readable/desirable spot price

One side effect of increasing precision as we get closer to the minimum tick is that multiple ticks can represent the same price. For example, tick -161795100 (along with the ticks surrounding it) correlate to a price of 0.000000000000000002. To get around any issues this may cause, when a position is created with a user defined lower and upper tick, we determine if a larger tick exists that represents the same price. If so, we use that tick instead of the user defined tick. In the above example, the tick would be changed to -161000000, which is the first tick that represents the same price.

Concentrated Liquidity Module Messages

MsgCreatePosition

- Request

This message allows LPs to provide liquidity between LowerTick and UpperTick

in a given PoolId. The user provides the amount of each token desired. Since

LPs are only allowed to provide liquidity proportional to the existing reserves,

the actual amount of tokens used might differ from requested. As a result, LPs

may also provide the minimum amount of each token to be used so that the system fails

to create position if the desired amounts cannot be satisfied.

Three KV stores are initialized when a position is created:

Position ID -> Position- This is a mapping from a unique position ID to a position object. The position ID is a monotonically increasing integer that is incremented every time a new position is created.Owner | Pool ID | Position ID -> Position ID- This is a mapping from a composite key of the owner address, pool ID, and position ID to the position ID. This is used to keep track of all positions owned by a given owner in a given pool.Pool ID -> Position ID- This is a mapping from a pool ID to a position ID. This is used to keep track of all positions in a given pool.

type MsgCreatePosition struct {

PoolId uint64

Sender string

LowerTick int64

UpperTick int64

TokenDesired0 types.Coin

TokenDesired1 types.Coin

TokenMinAmount0 github_com_cosmos_cosmos_sdk_types.Int

TokenMinAmount1 github_com_cosmos_cosmos_sdk_types.Int

}

- Response

On succesful response, we receive the actual amounts of each token used to create the liquidityCreated number of shares in the given range.

type MsgCreatePositionResponse struct {

PositionId uint64

Amount0 github_com_cosmos_cosmos_sdk_types.Int

Amount1 github_com_cosmos_cosmos_sdk_types.Int

JoinTime google.protobuf.Timestamp

LiquidityCreated github_com_cosmos_cosmos_sdk_types.Dec

}

This message should call the createPosition keeper method that is introduced

in the "Liquidity Provision" section of this document.

MsgWithdrawPosition

- Request

This message allows LPs to withdraw their position via their position ID,

potentially in partial amount of liquidity. It should fail if the position ID

does not exist or if attempting to withdraw an amount higher than originally

provided. If an LP withdraws all of their liquidity from a position, then the

position is deleted from state along with the three KV stores that were

initialized in the MsgCreatePosition section. However, the spread factor accumulators

associated with the position are still retained until a user claims them manually.

type MsgWithdrawPosition struct {

PositionId uint64

Sender string

LiquidityAmount github_com_cosmos_cosmos_sdk_types.Dec

}

- Response

On successful response, we receive the amounts of each token withdrawn for the provided share liquidity amount.

type MsgWithdrawPositionResponse struct {

Amount0 github_com_cosmos_cosmos_sdk_types.Int

Amount1 github_com_cosmos_cosmos_sdk_types.Int

}

This message should call the withdrawPosition keeper method that is introduced

in the "Liquidity Provision" section of this document.

MsgCreatePool

This message is responsible for creating a concentrated-liquidity pool.

It propagates the execution flow to the x/poolmanager module for pool id

management and for routing swaps.

type MsgCreateConcentratedPool struct {

Sender string

Denom0 string

Denom1 string

TickSpacing uint64

SpreadFactor github_com_cosmos_cosmos_sdk_types.Dec

}

- Response

On successful response, the pool id is returned.

type MsgCreateConcentratedPoolResponse struct {

PoolID uint64

}

MsgCollectSpreadRewards

This message allows collecting rewards from spreads for multiple position IDs from a single owner.

The spread factor collection is discussed in more detail in the "Spread Rewards" section of this document.

type MsgCollectSpreadRewards struct {

PositionIds []uint64

Sender string

}

- Response

On successful response, the collected tokens are returned. The sender should also see their balance increase by the returned amounts.

type MsgCollectSpreadRewardsResponse struct {

CollectedSpreadRewards []types.Coin

}

MsgFungifyChargedPositions

This message allows fungifying the fully charged unlocked positions belonging to the same owner and located in the same tick range. MsgFungifyChargedPosition takes in a list of positionIds and combines them into a single position. It validates that all positions belong to the same owner, are in the same ticks and are fully charged. Fails if not. Otherwise, it creates a completely new position P. P's liquidity equals to the sum of all liquidities of positions given by positionIds. The uptime of the join time of the new position equals to current block time - max authorized uptime duration (to signify that it is fully charged). The previous positions are deleted from state. Prior to deleting, the rewards are claimed. The old position's unclaimed rewards are transferred to the new position. The new position ID is returned.

type MsgFungifyChargedPositions struct {

PositionIds []uint64

Sender string

}

- Response

On successful response, the new position id is returned.

type MsgFungifyChargedPositionsResponse struct {

NewPositionId uint64

}

Relationship to Pool Manager Module

Pool Creation

As previously mentioned, the x/poolmanager is responsible for creating the

pool upon being called from the x/concentrated-liquidity module's message server.

It does so to store the mapping from pool id to concentrated-liquidity module so that it knows where to route swaps.

Upon successful pool creation and pool id assignment, the x/poolmanager module

returns the execution to x/concentrated-liquidity module by calling InitializePool

on the x/concentrated-liquidity keeper.

The InitializePool method is responsible for doing concentrated-liquidity specific

initialization and storing the pool in state.

Note, that InitializePool is a method defined on the SwapI interface that is

implemented by all swap modules. For example, x/gamm also implements it so that

x/pool-manager can route pool initialization there as well.

Swaps

We rely on the swap messages located in x/poolmanager:

MsgSwapExactAmountInMsgSwapExactAmountOut

The x/poolmanager received the swap messages and, as long as the swap's pool id

is associated with the concentrated-liquidity pool, the swap is routed

into the relevant module. The routing is done via the mapping from state that was

discussed in the "Pool Creation" section.

Liquidity Provision

As an LP, I want to provide liquidity in ranges so that I can achieve greater capital efficiency

This is a basic function that should allow LPs to provide liquidity in specific ranges to a pool.

A pool's liquidity is consisted of two assets: asset0 and asset1. In all pools, asset1 will be the quote asset and must be an approved denom listed in the module parameters. At the current tick, the bucket at this tick consists of a mix of both asset0 and asset1 and is called the virtual liquidity of the pool (or "L" for short). Any positions set below the current price are consisted solely of asset0 while positions above the current price only contain asset1.

Adding Liquidity

We can either provide liquidity above or below the current price, which would act as a range order, or decide to provide liquidity at the current price.

As declared in the API for createPosition, users provide the upper and lower

tick to denote the range they want to provide the liquidity in. The users are

also prompted to provide the amount of token0 and token1 they desire to receive.

The liquidity that needs to be provided for the given token0 and token1 amounts

would be then calculated by the following methods:

Liquidity needed for token0: $$L = \frac{\Delta x \sqrt{P_u} \sqrt{P_l}}{\sqrt{P_u} - \sqrt{P_l}}$$

Liquidity needed for token1: $$L = \frac{\Delta y}{\sqrt{P_u}-\sqrt{P_l}}$$

Then, we pick the smallest of the two values for choosing the final L. The

reason we do that is because the new liquidity must be proportional to the old

one. By choosing the smaller value, we distribute the liqudity evenly between

the two tokens. In the future steps, we will re-calculate the amount of token0

and token1 as a result the one that had higher liquidity will end up smaller

than originally given by the user.

Note that the liquidity used here does not represent an amount of a specific

token, but the liquidity of the pool itself, represented in sdk.Dec.

Using the provided liquidity, now we calculate the delta amount of both token0 and token1, using the following equations, where L is the liquidity calculated above:

$$\Delta x = \frac{L(\sqrt{p(i_u)} - \sqrt{p(i_c)})}{\sqrt{p(i_u)}\sqrt{p(i_c)}}$$ $$\Delta y = L(\sqrt{p(i_c)} - \sqrt{p(i_l)})$$

Again, by recalculating the delta amount of both tokens, we make sure that the new liquidity is proportional to the old one and the excess amount of the token that originally computed a larger liquidity is given back to the user.

The delta X and the delta Y are the actual amounts of tokens joined for the requested position.

Given the parameters needed for calculating the tokens needed for creating a position for a given tick, the API in the keeper layer would look like the following:

ctx sdk.Context, poolId uint64, owner sdk.AccAddress, amount0Desired,

amount1Desired, amount0Min, amount1Min sdk.Int,

lowerTick, upperTick int64, frozenUntil time.Time

func createPosition(

ctx sdk.Context,

poolId uint64,

owner sdk.AccAddress,

amount0Desired,

amount1Desired,

amount0Min,

amount1Min sdk.Int

lowerTick,

upperTick int64) (amount0, amount1 sdk.Int, sdk.Dec, error) {

...

}

Removing Liquidity

Removing liquidity is achieved via method withdrawPosition which is the inverse

of previously discussed createPosition. In fact, the two methods share the same

underlying logic, having the only difference being the sign of the liquidity.

Plus signifying addition while minus signifying subtraction.

Withdraw position also takes an additional parameter which represents the liqudity a user wants to remove. It must be less than or equal to the available liquidity in the position to be successful.

func (k Keeper) withdrawPosition(

ctx sdk.Context,

poolId uint64,

owner sdk.AccAddress,

lowerTick,

upperTick int64,

frozenUntil time.Time,

requestedLiquidityAmountToWithdraw sdk.Dec)

(amtDenom0, amtDenom1 sdk.Int, err error) {

...

}

Swapping

As a trader, I want to be able to swap over a concentrated liquidity pool so that my trades incur lower slippage

Unlike balancer pools where liquidity is spread out over an infinite range, concentrated liquidity pools allow for LPs to provide deeper liquidity for specific price ranges, which in turn allows traders to incur less slippage on their trades.

Despite this improvement, the liquidity at the current price is still finite, and large single trades in times of high volume, as well as trades against volatile assets, are eventually bound to incur some slippage.

In order to determine the depth of liquidity and subsequent amountIn/amountOut values for a given pool, we track the swap's state across multiple swap "steps". You can think of each of these steps as the current price following the original xy=k curve, with the far left bound being the next initialized tick below the current price and the far right bound being the next initialized tick above the current price. It is also important to note that we always view prices of asset1 in terms of asset0, and selling asset1 for asset0 would, in turn, increase its spot price. The reciprocal is also true, where if we sell asset0 for asset1, we would decrease the pool's spot price.

When a user swaps asset0 for asset1 (can also be seen as "selling" asset0), we move left along the curve until asset1 reserves in this tick are depleted. If the tick of the current price has enough liquidity to fulfill the order without stepping to the next tick, the order is complete. If we deplete all of asset1 in the current tick, this then marks the end of the first swap "step". Since all liquidity in this tick has been depleted, we search for the next closest tick to the left of the current tick that has liquidity. Once we reach this tick, we determine how much more of asset1 is needed to complete the swap. This process continues until either the entire order is fulfilled or all liquidity is drained from the pool.

The same logic is true for swapping asset1, which is analogous to buying asset0; however, instead of moving left along the set of curves, we instead search for liquidity to the right.

From the user perspective, there are two ways to swap:

Swap given token in for token out.

- E.g. I have 1 ETH that I swap for some computed amount of DAI.

Swap given token out for token in

- E.g. I want to get out 3000 DAI for some amount of ETH to compute.

Each case has a corresponding message discussed previosly in the x/poolmanager

section.

MsgSwapExactInMsgSwapExactOut

Once a message is received by the x/poolmanager, it is propageted into a

corresponding keeper

in x/concentrated-liquidity.

The relevant keeper method then calls its non-mutative calc version which is

one of:

calcOutAmtGivenIncalcInAmtGivenOut

State updates only occur upon successful execution of the swap inside the calc method.

We ensure that calc does not update state by injecting sdk.CacheContext as its

context parameter. The cache context is dropped on failure and committed on success.

Calculating Swap Amounts

Let's now focus on the core logic of calculating swap amounts.

We mainly focus on calcOutAmtGivenIn as the high-level steps of calcInAmtGivenOut

are similar.

1. Determine Swap Strategy

The first step we need to determine is the swap strategy. The swap strategy determines the direction of the swap, and it is one of:

zeroForOne- swap token zero in for token one out.oneForZero- swap token one in for token zero out.

Note that the first token in the strategy name always corresponds to the token

being swapped in, while the second token corresponds to the token being swapped

out. This is true for both calcOutAmtGivenIn and calcInAmtGivenOut calc methods.

Recall that, in our model, we fix the tokens axis at the time of pool creation. The token on the x-axis is token zero, while the token on the y-axis is token one.

Given that the sqrt price is defined as $$\sqrt (y / x)$$, as we swap token zero (x-axis) in for token one (y-axis), we decrease the sqrt price and move down along the price/tick curve. Conversely, as we swap token one (y-axis) in for token zero (x-axis), we increase the sqrt price and move up along the price/tick curve.

The reason we call this a price/tick curve is because there is a relationship between the price and the tick. As a result, when we perform the swap, we are likely to end up crossing a tick boundary. As a tick is crossed, the swap state internals must be updated. We will discuss this in more detail later.

2. Initialize Swap State

The next step is to initialize the swap state. The swap state is a struct that contains all of the swap state to be done within the current active tick (before we across a tick boundary).

It contains the following fields:

// SwapState defines the state of a swap.

// It is initialized as the swap begins and is updated after every swap step.

// Once the swap is complete, this state is either returned to the estimate

// swap querier or committed to state.

type SwapState struct {

// Remaining amount of specified token.

// if out given in, amount of token being swapped in.

// if in given out, amount of token being swapped out.

// Initialized to the amount of the token specified by the user.

// Updated after every swap step.

amountSpecifiedRemaining sdk.Dec

// Amount of the other token that is calculated from the specified token.

// if out given in, amount of token swapped out.

// if in given out, amount of token swapped in.

// Initialized to zero.

// Updated after every swap step.

amountCalculated sdk.Dec

// Current sqrt price while calculating swap.

// Initialized to the pool's current sqrt price.

// Updated after every swap step.

sqrtPrice sdk.Dec

// Current tick while calculating swap.

// Initialized to the pool's current tick.

// Updated each time a tick is crossed.

tick sdk.Int

// Current liqudiity within the active tick.

// Initialized to the pool's current tick's liquidity.

// Updated each time a tick is crossed.

liquidity sdk.Dec

// Global spread reward growth per-current swap.

// Initialized to zero.

// Updated after every swap step.

spreadRewardGrowthGlobal sdk.Dec

}

3. Compute Swap

The next step is to compute the swap. Conceptually, it can be done in two ways listed below.Before doing so, we find the next initialized tick. An initialized tick is the tick that is touched by the edges of at least one position. If no position has an edge at a tick, then that tick is uninitialized.

a. Swap within the same initialized tick range.

See "Appendix A" for details on what "initialized" means.

This case occurs when swapState.amountSpecifiedRemaining is less than or equal

to the amount needed to reach the next tick. We omit the math needed to determine

how much is enough until a later section.

b. Swap across multiple initialized tick ranges.

See "Appendix A" for details on what "initialized" means.

This case occurs when swapState.amountSpecifiedRemaining is greater than the

amount needed to reach the next tick

In terms of the code implementation, we loop, calling a swapStrategy.ComputeSwapStepOutGivenIn

or swapStrategy.ComputeSwapStepInGivenOut method, depending on swap out given

in or in given out, respectively.

The swap strategy is already initialized to be either zeroForOne or oneForZero

from step 1. Go dynamically determines the desired implementation via polymorphism.

We leave details of the ComputeSwapStepOutGivenIn and ComputeSwapStepInGivenOut

methods to the appendix of the "Swapping" section.

The iteration stops when swapState.amountSpecifiedRemaining runs out or when

swapState.sqrtPrice reaches the sqrt price limit specified by the user as a price

impact protection.

4. Update Swap State

Upon computing the swap step, we update the swap state with the results of the swap step. Namely,

Subtract the consumed specified amount from

swapState.amountSpecifiedRemaining.Add the calculated amount to

swapState.amountCalculated.Update

swapState.sqrtPriceto the new sqrt price. The new sqrt price is not necessarily the sqrt price of the next tick. It is the sqrt price of the next tick if the swap step crosses a tick boundary. Otherwise, it is something in between the original and the next tick sqrt price.Update

swapState.tickto the next initialized tick if it is reached; otherwise, update it to the new tick calculated from the new sqrt price. If the sqrt price is unchanged, the tick remains unchanged as well.Update

swapState.liquidityto the new liquidity only if the next initialized tick is crossed. The liquidity is updated by incorporating theliquidity_netamount associated with the next initialized tick being crossed.Update

swapState.spreadRewardGrowthGlobalto the value of the total spread factor charged within the swap step on the amount of token in per one unit of liquidity within the tick range being swapped in.

Then, we either proceed to the next swap step or finalize the swap.

5. Update Global State

Once the swap is completed, we persiste the swap state to the global state

(if mutative action is performed) and return the amountCalculated to the user.

Migration

Users can migrate their Balancer positions to a Concentrated Liquidity full range position provided the underlying Balancer pool has a governance-selected canonical Concentrated Liquidity pool. The migration is routed depending on the state of the underlying Balancer position:

Balancer position is:

- Superfluid delegated

- Locked

- Superfluid undelegating

- Locked

- Unlocking

- Normal lock

- Locked

- Unlocking

- Unlocked

Regardless of the path taken, the UnlockAndMigrateSharesToFullRangeConcentratedPosition

message executes all of the below logic:

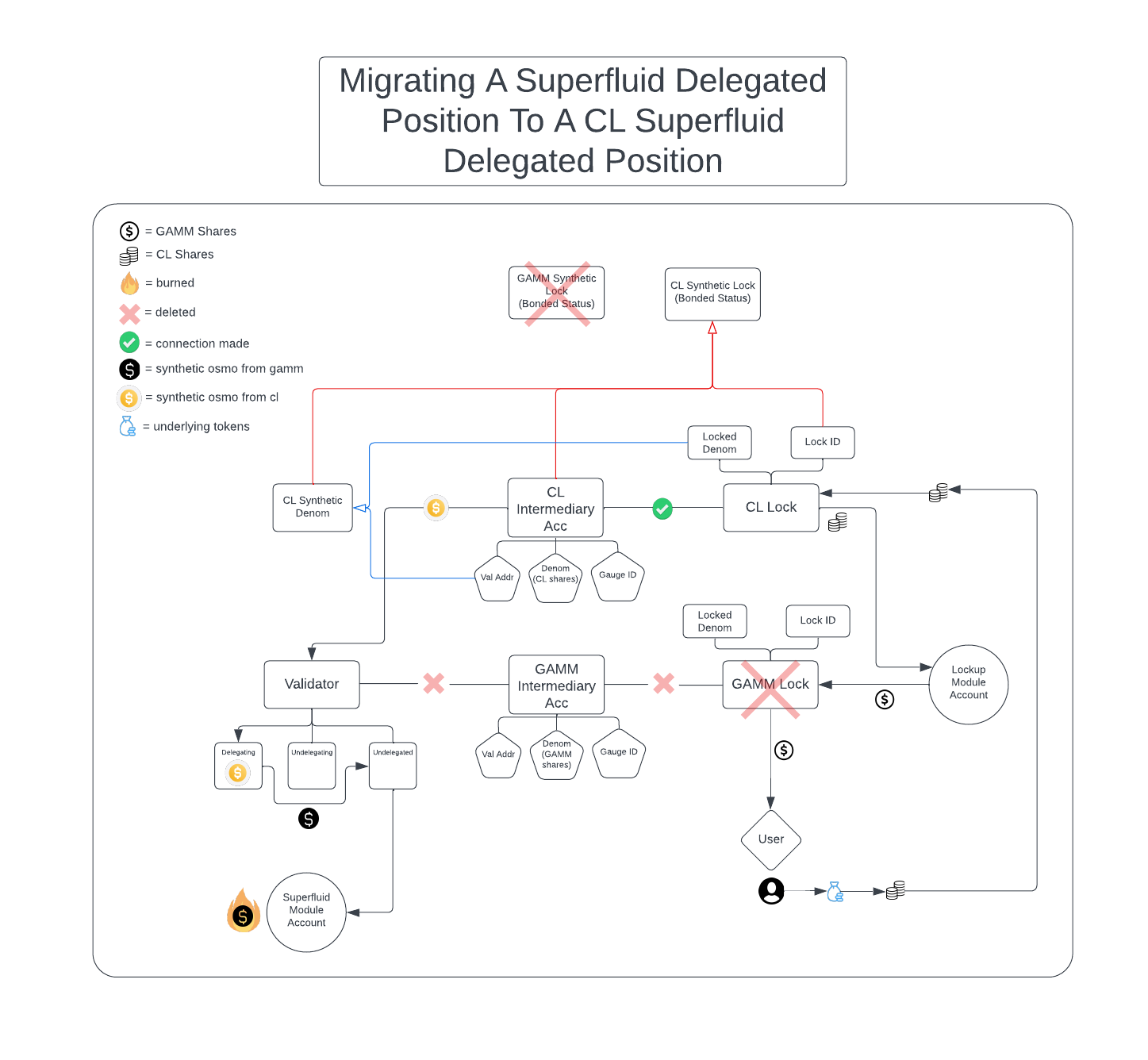

Superfluid Delegated Balancer to Concentrated

The following diagram illustrates the migration flow for a Superfluid delegated Balancer position to a Superfluid delegated Concentrated Liquidity position.

The migration process starts by removing the connection between the GAMM lock and the GAMM intermediary account. The synthetic OSMO that was previously minted by the GAMM intermediary account is immediately undelegated (skipping the two-week unbonding period) and sent to the Superfluid module account where it is burned.

Next, the Lockup module account holding the original GAMM shares sends them back to the user, deleting the GAMM lock in the process. These shares are used to claim the underlying two assets from the GAMM pool, which are then immediately put into a full range Concentrated Liquidity position in the canonical Concentrated Liquidity pool.

The underlying liquidity this creates is tokenized (similar to GAMM shares) and is put into a new lock, which is then routed to the Lockup module account. A new intermediary account is created based on this new CL share denom. The new intermediary account mints synthetic OSMO and delegates it to the validator the user originally delegated to. Finally, a new synthetic lock in a bonded status is created based on the new CL lock ID, the new CL intermediary account, and the new CL synthetic denom.

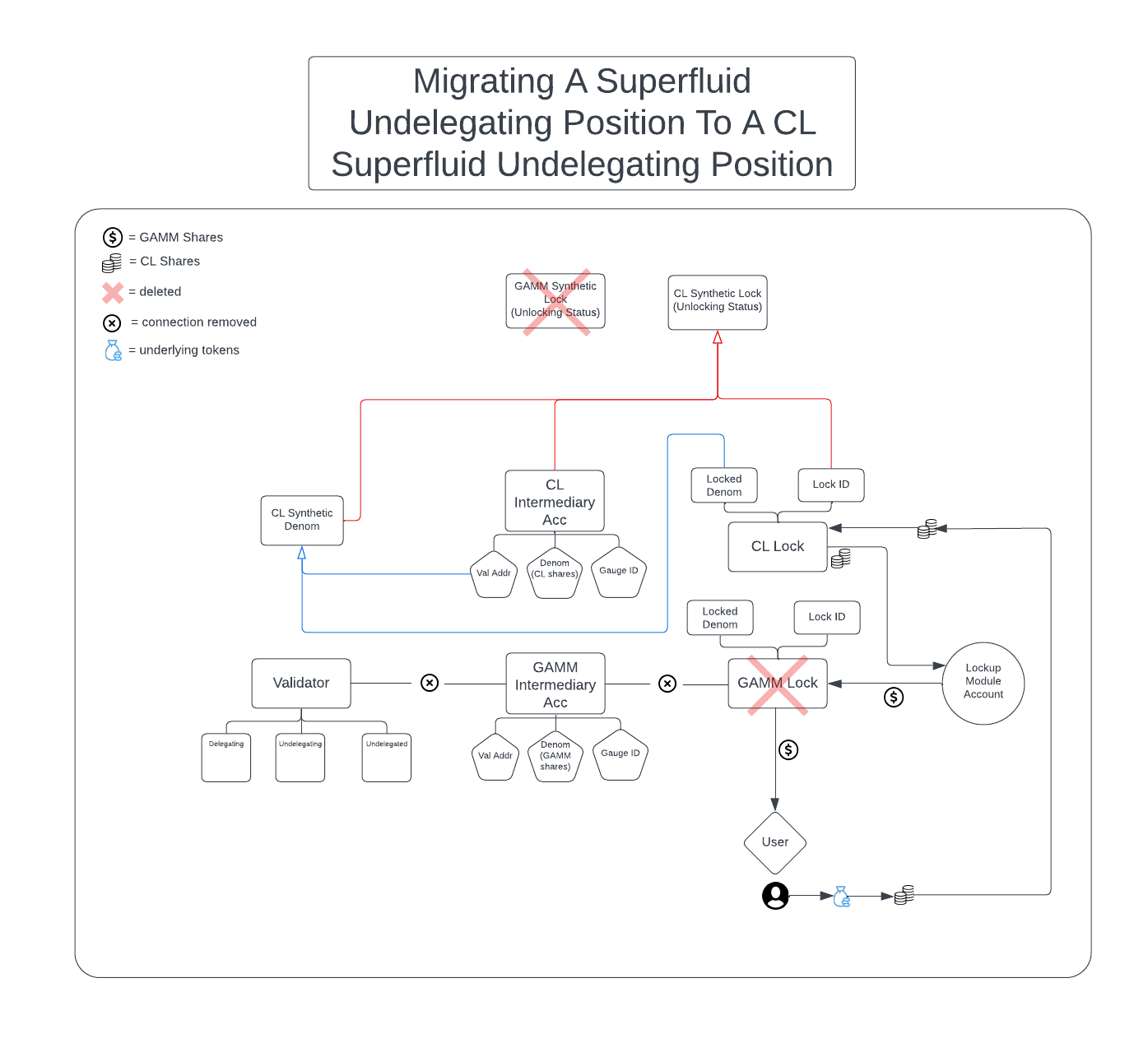

Superfluid Undelegating Balancer to Concentrated

The following diagram illustrates the migration flow for a superfluid undelegating balancer position to a superfluid undelegating concentrated liquidity position. The reason we must account for this situation is to respect the two week unbonding period that is required for superfluid undelegating, and be capable of slashing a position that was migrated.

The process is identical to the Superfluid delegated migration, with three exceptions. First, the connection between the GAMM intermediary account and the GAMM lock is already removed when a user started undelegation, so it does not need to be done again. Second, no synthetic OSMO needs to be burned or created. Lastly, instead of creating a new CL synthetic lock in a bonded status, we create a new CL synthetic lock in an unlocking status. This lock will be unlocked once the two-week unbonding period is over.

Locked and Unlocked Balancer to Concentrated

The locked<>locked and unlocked<>unlocked migration utilizes a subset of actions

that were taken in the superfluid migration. The Lockup module account that was

holding the original GAMM shares sends them back to the user, deleting the GAMM

lock in the process. These shares are used to claim the underlying two assets

from the GAMM pool, which are then immediately put into a full range Concentrated

Liquidity position in the canonical Concentrated Liquidity pool.

If it was previously locked, we keep the concentrated locked for the same period of time. If it was previously unlocking, we begin unlocking the concentrated lock from where the GAMM lock left off.

Balancer to Concentrated with No Lock

When GAMM shares are not locked, they are simply claimed for the underlying two assets, which are then immediately put into a full range concentrated liquidity position in the canonical concentrated liquidity pool. No locks are involved in this migration.

Position Fungification

There is a possibility to fungify fully-charged positions within the same tick range. Assume that there are two positions in the same tick range and both are fully charged.

As a user, I might want to combine them into a single position so that I don't have to manage positions inside the same tick range separately.

Therefore, I execute MsgFungifyChargedPositions that takes a list of position ids to fungify

and merges them into one.

Besides being fully charged, all of the positions must be in the same tick range and have the same owner (sender). All must belong to the same pool and be unlocked. As a result, none of the positions can be superfluid staked if they are full-range.

Once the message finishes, the user will have a completely new position with spread factors and incentive rewards moved into the new position. The old positions will be deleted.

Swapping. Appendix A: Example

Note, that the numbers used in this example are not realistic. They are used to illustrate the concepts on the high level.

Imagine a tick range from min tick -1000 to max tick 1000 in a pool with a 1% spread factor.

Assume that user A created a full range position from ticks -1000 to 1000 for

10_000 liquidity units.

Assume that user B created a narrow range position from ticks 0 to 100 for 1_000

liquidity units.

Assume the current active tick is -34 and user perform a swap in the positive direction of the tick range by swapping 5_000 tokens one in for some tokens zero out.

Our tick range and liquidity graph now looks like this:

cur_sqrt_price ////////// <--- position by user B

///////////////////////////////////////////////////////// <---position by user A

-1000 -34 0 100 1000

The swap state is initialized as follows:

amountSpecifiedRemainingis set to 5_000 tokens one in specified by the user.amountCalculatedis set to zero.sqrtPriceis set to the current sqrt price of the pool (computed from the tick -34)tickis set to the current tick of the pool (-34)liquidityis set to the current liquidity tracked by the pool at tick -34 (10_000)spreadRewardGrowthGlobalis set to (0)

We proceed by getting the next initialized tick in the direction of the swap (0).

Each initialized tick has 2 fields:

liquidity_gross- this is the total liquidity referencing that tick at tick -1000: 10_000 at tick 0: 1_000 at tick 100: 1_000 at tick 1000: 10_000liquidity_net- liquidity that needs to be added to the active liquidity as we cross the tick moving in the positive direction so that the active liquidity is always the sum of allliquidity_netamounts of initialized ticks below the current one. at tick -1000: 10_000 at tick 0: 1_000 at tick 100: -1_000 at tick 1000: -10_000

Next, we compute swap step from tick -34 to tick 0. Assume that 5_000 tokens one in is more than enough to cross tick 0 and it returns 10_000 of token zero out while consuming half of token one in (2500).

Now, we update the swap state as follows:

amountSpecifiedRemainingis set to 5000 - 2_500 = 2_500 tokens one in remaining.amountCalculatedis set to 10_000 tokens zero out calculated.sqrtPriceis set to the sqrt price of the crossed initialized tick 0 (0).tickis set to the tick of the crossed initialized tick 0 (0).liquidityis set to the old liquidity value (10_000) + theliquidity_netof the crossed tick 0 (1_000) = 11_000.spreadRewardGrowthGlobalis set to 2_500 * 0.01 / 10_000 = 0.0025 because we assumed 1% spread factor.

Now, we proceed by getting the next initialized tick in the direction of the swap (100).

Next, we compute swap step from tick 0 to tick 100. Assume that 2_500 remaining tokens one in is not enough to reach the next initialized tick 100 and it returns 12_500 of token zero out while only reaching tick 70. The reason why we now get a greater amount of token zero out for the same amount of token one in is because the liquidity in this tick range is greater than the liquidity in the previous tick range.

Now, we update the swap state as follows:

amountSpecifiedRemainingis set to 2_500 - 2_500 = 0 tokens one in remaining.amountCalculatedis set to 10_000 + 12_500 = 22_500 tokens zero out calculated.sqrtPriceis set to the reached sqrt price.tickis set to an uninitialized tick associated with the reached sqrt price (70).liquidityis set kept the same as we did not cross any initialized tick.spreadRewardGrowthGlobalis updated to 0.0025 + (2_500 * 0.01 / 10_000) = 0.005 because we assumed 1% spread factor.

As a result, we complete the swap having swapped 5_000 tokens one in for 22_500 tokens zero out. The tick is now at 70 and the current liquidity at the active tick tracked by the pool is 11_000. The global spread reward growth per unit of liquidity has increased by 50 units of token one. See more details about the spread reward growth in the "Spread Rewards" section.

TODO: Swapping, Appendix B: Compute Swap Step Internals and Math

Range Orders

As a trader, I want to be able to execute ranger orders so that I have better control of the price at which I trade

TODO

Spread Rewards

As a an LP, I want to earn spread rewards on my capital so that I am incentivized to participate in active market making.

In Balancer-style pools, spread rewards go directly back into the pool to benefit all LPs pro-rata. For concentrated liquidity pools, this approach is no longer feasible due to the non-fungible property of positions. As a result, we use a different accumulator-based mechanism for tracking and storing spread rewards.

Reference the following papers for more information on the inspiration behind our accumulator package:

We define the following accumulator and spread-reward-related fields to be stored on various layers of state:

- Per-pool

// Note that this is proto-generated.

type Pool struct {

...

SpreadFactor sdk.Dec

}

Each pool is initialized with a static spread factor value SpreadFactor to be paid by swappers.

Additionally, each pool's spread reward accumulator tracks and stores the total rewards accrued from spreads

throughout its lifespan, named SpreadRewardGrowthGlobal.

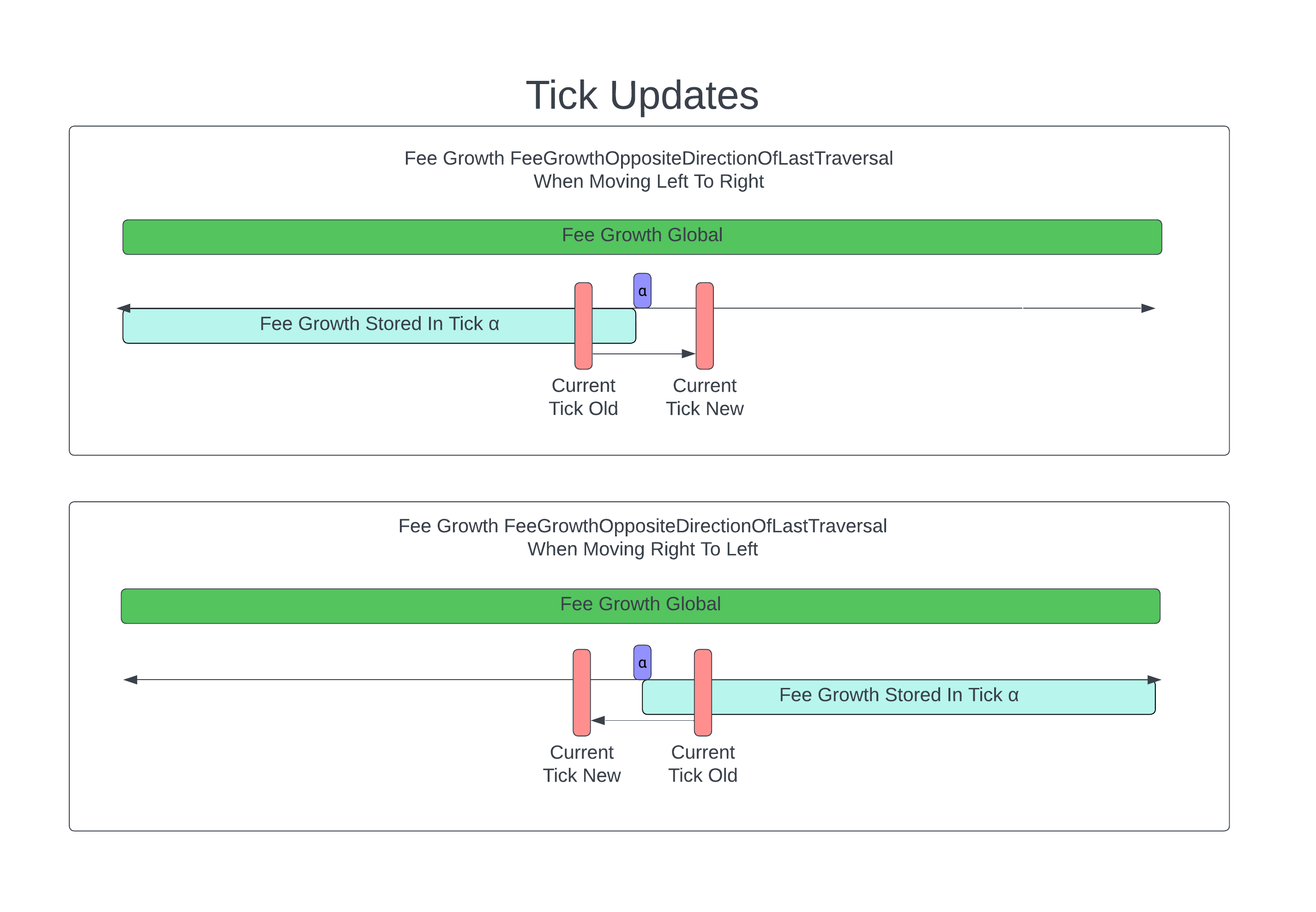

- Per-tick

// Note that this is proto-generated.

type TickInfo struct {

...

SpreadRewardGrowthOppositeDirectionOfLastTraversal sdk.DecCoins

}

TickInfo keeps a record of spread rewards accumulated opposite the direction the tick was last traversed.

In other words, when traversing the tick from right to left, SpreadRewardGrowthOppositeDirectionOfLastTraversal

represents the spread rewards accumulated above that tick. When traversing the tick from left to right,

SpreadRewardGrowthOppositeDirectionOfLastTraversal represents the spread rewards accumulated below that tick.

This information is required for calculating the amount of spread rewards that accrue between a range of two ticks.

Note that keeping track of the spread reward growth is only necessary for the ticks that have been initialized. In other words, at least one position must be referencing that tick to require tracking the spread reward growth occurring in that tick.

By convention, when a new tick is activated, it is set to the pool's SpreadRewardGrowthGlobal

if the tick being initialized is above the current tick.

See the following code snippet:

if tickIndex <= currentTick {

accum, err := k.GetSpreadRewardAccumulator(ctx, poolId)

if err != nil {

return err

}

tickInfo.SpreadRewardGrowthBelow = accum.GetValue()

}

Essentially, setting the tick's tickInfo.SpreadRewardGrowthOppositeDirectionOfLastTraversal

to the pools accum value represents the amount of spread rewards collected by the pool up until

the tick was activated.

Once a tick is activated again (crossed in either direction),

tickInfo.SpreadRewardGrowthOppositeDirectionOfLastTraversal is updated to add the difference

between the pool's current accumulator value and the old value of

tickInfo.SpreadRewardGrowthOppositeDirectionOfLastTraversal.

Tracking how many spread rewards are collected below, in the case of a lower tick, and above, in the case of an upper tick, allows us to calculate the amount of spread rewards inside a position (spread reward growth inside between two ticks) on demand. This is done by updating the activated tick with the amount of spread rewards collected for every tick lower than the tick that is being crossed.

This has two benefits:

- We avoid updating all ticks

- We can calculate a range by subtracting the upper and lower ticks for the range using the logic below.

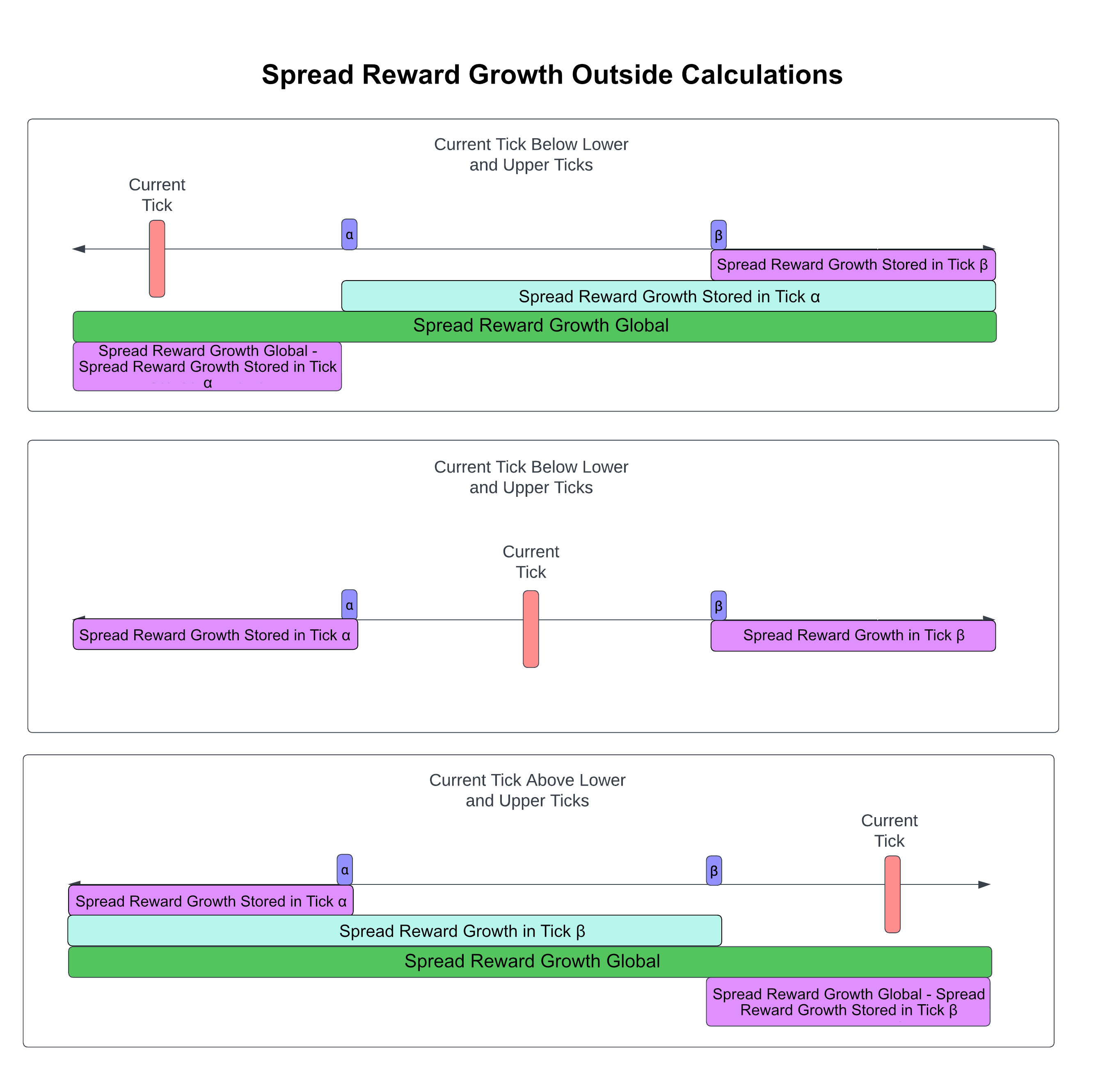

We calculate the spread reward growth above the upper tick in the following way:

- If calculating spread reward growth for an upper tick, we consider the following two cases:

- currentTick >= upperTick: If the current tick is greater than or equal to the upper tick, the spread reward growth would be the pool's spread reward growth minus the upper tick's

- currentTick < upperTick: If the current tick is smaller than the upper tick, the spread reward growth would be the upper tick's spread reward growth outside.

This process is vice versa for calculating spread reward growth below the lower tick.

Now, by having the spread reward growth below the lower and above the upper tick of a range, we can calculate the spread reward growth inside the range by subtracting the two from the global per-unit-of-liquidity spread reward growth.

spreadRewardGrowthInsideRange := SpreadRewardGrowthGlobalOutside - spreadRewardGrowthBelowLowerTick - spreadRewardGrowthAboveUpperTick

Note that although tickInfo.SpreadRewardGrowthOutside may be initialized at different times

for each tick, the comparison of these values between ticks is not meaningful, and

there is no guarantee that the values across ticks will follow any particular pattern.

However, this does not affect the per-position calculations since all the position

needs to know is the spread reward growth inside the position's range since the position was

last interacted with.

- Per-position-accumulator

In a concentrated liquidity pool, unlike traditional pools, spread rewards do not get automatically

re-added to pool. Instead, they are tracked by the unclaimedRewards fields of each

position's accumulator.

The amount of uncollected spread rewards needs to be calculated every time a user modifies their position. This occurs when a position is created, and liquidity is removed (liquidity added is analogous to creating a new position).

We must recalculate the values for any modification, because with a change in liquidity for the position, the amount of spread rewards allocated to the position must also change accordingly.

Collecting Spread Rewards

Once calculated, collecting spread rewards is a straightforward process of transferring the calculated amount from the pool address to the position owner.

To collect spread rewards, users call MsgCollectSpreadRewards with the ID corresponding to

their position. The function collectSpreadRewards in the keeper is responsible for

executing the spread reward collection and returning the amount collected, given the owner's

address and the position ID:

func (k Keeper) collectSpreadRewards(

ctx sdk.Context,

owner sdk.AccAddress,

positionId uint64) (sdk.Coins, error) {

}

This returns the amount of spread rewards collected by the user.

Swaps

Swapping within a single tick works as the regular xy = k curve. For swaps

across ticks to work, we simply apply the same spread reward calculation logic for every swap step.

Consider data structures defined above. Let tokenInAmt be the amount of token being

swapped in.

Then, to calculate the spread reward within a single tick, we perform the following steps:

- Calculate an updated

tokenInAmtAfterSpreadRewardby charging thepool.SpreadFactorontokenInAmt.

// Update global spread reward accumulator tracking spread rewards for denom of tokenInAmt.

// TODO: revisit to make sure if truncations need to happen.

pool.SpreadRewardGrowthGlobalOutside.TokenX = pool.SpreadRewardGrowthGlobalOutside.TokenX.Add(tokenInAmt.Mul(pool.SpreadFactor))

// Update tokenInAmt to account for spread factor.

spread_factor = tokenInAmt.Mul(pool.SpreadFactor).Ceil()

tokenInAmtAfterSpreadFactor = tokenInAmt.Sub(spread_factor)

k.bankKeeper.SendCoins(ctx, swapper, pool.GetAddress(), ...) // send tokenInAmtAfterSpreadFactor

- Proceed to calculating the next square root price by utilizing the updated `tokenInAmtAfterSpreadFactor.

Depending on which of the tokens in tokenIn,

If token1 is being swapped in: $$\Delta \sqrt P = \Delta y / L$$

Here, tokenInAmtAfterSpreadFactor is delta y.

If token0 is being swapped in: $$\Delta \sqrt P = L / \Delta x$$

Here, tokenInAmtAfterSpreadFactor is delta x.

Once we have the updated square root price, we can calculate the amount of

tokenOut to be returned. The returned tokenOut is computed with spread rewards

accounted for given that we used tokenInAmtAfterSpreadFactor.

Swap Step Spread Factors

We have a notion of swapState.amountSpecifiedRemaining which is the amount of

token in remaining over all swap steps.

After performing the current swap step, the following cases are possible:

- All amount remaining is consumed

In that case, the spread factor is equal to the difference between the original amount remaining and the one actually consumed. The difference between them is the spread factor.

spreadRewardChargeTotal = amountSpecifiedRemaining.Sub(amountIn)

- Did not consume amount remaining in-full.

The spread factor is charged on the amount actually consumed during a swap step.

spreadRewardChargeTotal = amountIn.Mul(spreadFactor)

- Price impact protection makes it exit before consuming all amount remaining.

The spread factor is charged on the amount in actually consumed before price impact protection got trigerred.

spreadRewardChargeTotal = amountIn.Mul(spreadFactor)

Incentive/Liquidity Mining Mechanism

Overview

Due to the nonfungibility of positions and ticks, incentives for concentrated liquidity requires a slightly different mechanism for distributing incentives compared to Balancer and Stableswap pools. In general, the design space of incentive mechanisms for concentrated liquidity DEXs is extremely underexplored, so our implementation takes this as an opportunity to break some new ground in the broader design space of order-book-style AMMs.

Below, we outline the approach for CL incentives that Osmosis will be implementing for its initial implementation of concentrated liquidity, as well as our baseline reasoning for why we are pursuing this design.

Target Properties

As a starting point, it's important to understand the properties of a healthy liquidity pool. These are all, of course, properties that become self-sustaining once the positive feedback cycle between liquidity and volume kicks off, but for the sake of understanding what exactly it is that we are trying to bootstrap with incentives it helps to be explicit with our goals.

Liquidity Depth

We want to ensure spread rewards and incentives are being used to maximize liquidity depth at the active tick (i.e. the tick the current spot price is in), as this gives the best execution price for trades on the pool.

Liquidity Breadth

It is critical that as we roll out concentrated liquidity, there is an incentive for there to be width in the books for our major pools. This is to avoid the scenario where the liquidity in the active tick gets filled and liquidity falls off a cliff (e.g. when there is a large price move and active tick LPs get bulk arbed against). It is important for our liquidity base to be broad when it is low until our CL markets mature and active LPs begin participating.

Liquidity Uptime

We want to ensure that the active tick is not only liquid, but that it is consistently liquid, meaning that liquidity providers are incentivized to keep their liquidity on the books while they trade.

Specifically, we want to ensure that idle liquidity waiting for volume does not sit off the books with the goal of jumping in when a trade happens, as this makes Osmosis's liquidity look thinner than it is and risks driving volume to other exchanges.

While just-in-time (JIT) liquidity technically benefits the trader on a first-degree basis (better price execution for that specific trade), it imposes a cost on the whole system by pushing LPs to an equilibrium that ultimately hurts the DEX (namely that liquidity stays of the books until a trade happens). This instance of Braess's paradox can be remedied with mechanisms designed around rewarding liquidity uptime.

Current Standard: Pro-rata in Active Tick

The current status quo for concentrated liquidity incentives is to distribute them pro-rata to all LPs providing liquidity in the active tick. With some clever accumulator tricks, this can be designed to ensure that each LP only receives incentives for liquidity they contribute to the active tick. This approach is incredible for liquidity depth, which is arguably the most important property we need incentives to be able to accommodate. It is also a user flow that on-chain market makers are already somewhat familiar with and has enough live examples where we roughly know that it functions as intended.

Our Implementation

At launch, Osmosis's CL incentives will primarily be in the format described above while we iron out a mechanism that achieves the remaining two properties predictably and effectively. As a piece of foreshadowing, the primary problem space we will be tackling is the following: status quo incentives advantage LPs who keep their liquidity off the books until a trade happens, ultimately pushing liquidity off of the DEX and creating ambiguity around the "real" liquidity depth. This forces traders to make uninformed decisions about where to trade their assets (or worse, accept worse execution on an inferior venue).

In other words, instead of having incentives go towards bootstrapping healthy liquidity pools, they risk going towards adversely pushing volume to other exchanges at the cost of the DEX, active LPs, and ultimately traders.

Note on supported and authorized uptimes

If you dig through our incentives logic, you might find code dealing with notions of Supported Uptimes and Authorized Uptimes. These are for an uptime incentivization mechanism we are keeping off at launch while we refine a more sophisticated version. We leave the state-related parts in core logic to ensure that if we do decide to turn the feature on (even if just to experiment), it could be done by a simple governance proposal (to add more supported uptimes to the list of authorized uptimes) and not require a state migration for pools. At launch, only the 1ns uptime will be authorized, which is roughly equivalent to status quo CL incentives with the small difference that positions that are created and closed in the same block are not eligible for any incentives.

For the sake of clarity, this mechanism functions very similarly to status quo incentives, but it has a separate accumulator for each supported uptime and ensures that only liquidity that has been in the pool for the required amount of time qualifies for claiming incentives.

Incentive Creation and Querying

While it is technically possible for Osmosis to enable the creation of incentive records directly in the CL module, incentive creation is currently funneled through existing gauge infrastructure in the x/incentives module. This simplifies UX drastically for frontends, external incentive creators, and governance, while making CL incentives fully backwards-compatible with incentive creation and querying flows that everyone is already used to. As of the initial version of Osmosis's CL, all incentive creation and querying logic will be handled by respective gauge functions (e.g. the IncentivizedPools query in the x/incentives module will include CL pools that have internal incentives on them).

To create a gauge dedicated to the concentrated liquidity pool, run a MsgCreateGauge message in the x/incentives module with the following parameter constraints:

PoolId: The ID of the CL pool to create a gauge for.DistrTo.LockQueryTypemust be set tolocktypes.LockQueryType.NoLockDistrTo.Denommust be an empty string.

The rest of the parameters can be set according to the desired configuration of the gauge. Please read the x/incentives module documentation for more information on how to configure gauges.

Note, that the created gauge will start emitting at the first epoch after the given StartTime. During the epoch, a x/concentrated-liquidity

module IncentiveRecord will be created for every denom in the gauge. This incentive record will be configured to emit all given incentives

over the period of an epoch. If the gauge is non-perpetual (emits over several epochs), the distribution will be split evenly between the epochs.

and a new IncentiveRecord will be created for each denom every epoch with the emission rate and token set to finish emitting at the end of the epoch.

Reward Splitting Between Classic and CL pools

While we want to nudge Classic pool LPs to transition to CL pools, we also want to ensure that we do not have a hard cutoff for incentives where past a certain point it is no longer worth it to provide liquidity to Classic pools. This is because we want to ensure that we have a healthy transition period where liquidity is not split between Classic and CL pools, but rather that liquidity is added to CL pools while Classic pools are slowly drained of liquidity.

To achieve this in a way that is difficult to game and efficient for the chain to process, we will be using a reward-splitting mechanism that treats bonded liquidity in a Classic pool that is paired by governance to a CL pool (e.g. for the purpose of migration) as a single full-range position on the CL pool for the purpose of calculating incentives. Note that this does not affect spread reward distribution and only applies to the flow of incentives through a CL pool.

One implication of this mechanism is that it moves the incentivization process to a higher level of abstraction (incentivizing pairs instead of pools). For internal incentives (which are governance managed), this is in line with the goal of continuing to push governance to require less frequent actions, which this change ultimately does.

To keep a small but meaningful incentive for LPs to still migrate their positions, we have added a discount rate to incentives that are redirected to Classic pools. This is initialized to 5% by default but is a governance-upgradable parameter that can be increased in the future. A discount rate of 100% is functionally equivalent to all the incentives staying in the CL pool.

TWAP Integration

In the context of twap, concentrated liquidity pools function differently from CFMM pools.

There are 2 major differences that stem from how the liquidity is added and removed in concentrated-liquidity.

The first one is given by the fact that a user does not provide liquidity at

pool creation time. Instead, they have to issue a separate message post-pool

creation. As a result, there can be a time where there is no valid spot price

initialized for a concentrated liquidity pool. When a concentrated liquidity pool

is created, the x/twap module still initializes the twap records. However, these

records are invalidated by setting the "last error time" field to the block time

at pool creation. Only adding liquidity to the pool will initialize the spot price

and twap records correctly. One technical detail to note is that adding liquidity

in the same block as pool creation will still set the "last error time" field to

the block time despite spot price already being initialized. Although we fix an

error within that block, it still occurs. As a result, this is deemed acceptable.

However, this is a technical trade-off for implementation simplicity and not an

intentional design decision.

The second difference from balancer pools is focused around the fact that liquidity can be completely removed from a concentrated liquidity pool, making its spot price be invalid.

To recap the basic LP functionality in concentrated liquidity, a user adds liqudity by creating a position. To remove liquidity, they withdraw their position. Contrary to CFMM pools, adding or removing liquidity does not affect the price in 99% of the cases in concentrated liquidity. The only two exceptions to this rule are:

Creating the first position in the pool.

In this case, we transition from invalid state where there is no liqudity, and the spot price is uninitialized to the state where there is some liqudity, and as a result a valid spot price.

Note, that if there is a pool where liqudiity is completely drained and re-added, the TWAP's last error time will be pointing at the time when the liquidity was drained. This is different from how twap functions in CFMM pool where liquidity cannot be removed in-full.

Removing the last position in the pool.

In this case, we transition from a valid state with liquidity and spot price to an invalid state where there is no liquidity and, as a result, no valid spot price anymore. The last spot price error will be set to the block time of when the last position was removed.

To reiterate, the above two exceptions are the only cases where twap is updated due to adding or removing liquidity.

The major source of updates with respect to twap is the swap logic. It functions

similarly to CFMM pools where upon the completion of a swap, a listener AfterConcentratedPoolSwap

propagates the execution to the twap module for the purposes of tracking state updates

necessary to retrieve the spot price and update the twap accumulators

(more details in x/twap module).

Lastly, see the "Listeners" section for more details on how twap is enabled by the use of these hooks.

Parameters

AuthorizedQuoteDenoms[]string

This is a list of quote denoms that can be used as token1 when creating a pool. We limit the quote assets to a small set for the purposes of having convenient price increments stemming from tick to price conversion. These increments are in a human readable magnitude only for token1 as a quote. For limit orders in the future, this will be a desirable property in terms of UX as to allow users to set limit orders at prices in terms of token1 (quote asset) that are easy to reason about.

This goes in-hand with centralized exchanges that limit the quote asset set to only a few denoms.

Our list at launch is expected to consist of OSMO, DAI and USDC. These are set in the v16 upgrade handler.

IsPermisionlessPoolCreationEnabledbool

The flag indicating whether permissionless pool creation is enabled or not. For launch, we have decided to disable permissionless pool creation. It will still be enabled via governance. This is because we want to limit the number of pools for risk management and want to avoid fragmenting liquidity for major denom pairs with configurations of tick spacing that are not ideal.

Listeners

AfterConcentratedPoolCreated

This listener executes after the pool is created.

At the time of this writing, it is only utilized by the x/twap module.

The twap module is expected to create twap records where the last error time

is set to the block time of when the pool was created. This is because there

is no liquidity in the pool at creation time.

AfterInitialPoolPositionCreated

This listener executes after the first position is created in a concentrated liquidity pool.

At the time of this writing, it is only utilized by the x/twap module.

AfterLastPoolPositionRemoved

This listener executes after the last position is removed in a concentrated liquidity pool.

At the time of this writing, it is only utilized by the x/twap module.

AfterConcentratedPoolSwap

This listener executes after a swap in a concentrated liquidity pool.

At the time of this writing, it is only utilized by the x/twap module.

State entries and KV store management

The following are the state entries (key and value pairs) stored for the concentrated liquidity module.

- structs

- TickPrefix + pool ID + tickIndex ➝ Tick Info struct

- PoolPrefix + pool id ➝ pool struct

- IncentivePrefix | pool id | min uptime index | denom | addr ➝ Incentive Record body struct

- links

- positionToLockPrefix | position id ➝ lock id

- lockToPositionPrefix | lock id ➝ position id

- PositionPrefix | addr bytes | pool id | position id ➝ boolean

- PoolPositionPrefix | pool id | position id ➝ boolean

Note that for storing ticks, we use 9 bytes instead of directly using uint64, first byte being reserved for the Negative / Positive prefix, and the remaining 8 bytes being reserved for the tick itself, which is of uint64. Although we directly store signed integers as values, we use the first byte to indicate and re-arrange tick indexes from negative to positive.

State and Keys

Incentive Records

KeyIncentiveRecord

0x04| || string encoding of pool ID || | || string encoding of min uptime index || | || string encoding of incentive ID

Note that the reason for having pool ID and min uptime index is so that we can retrieve all incentive records for a given pool ID and min uptime index by performing prefix iteration.

Precision Issues With Price

There are precision issues that we must be considerate of in our design.

Consider the balancer pool between arb base unit and uosmo:

osmosisd q gamm pool 1011

pool:

'@type': /osmosis.gamm.v1beta1.Pool

address: osmo1pv6ffw8whyle2nyxhh8re44k4mu4smqd7fd66cu2y8gftw3473csxft8y5

future_pool_governor: 24h

id: "1011"

pool_assets:

- token:

amount: "101170077995723619690981"

denom: ibc/10E5E5B06D78FFBB61FD9F89209DEE5FD4446ED0550CBB8E3747DA79E10D9DC6

weight: "536870912000000"

- token:

amount: "218023341414"

denom: uosmo

weight: "536870912000000"

pool_params:

exit_fee: "0.000000000000000000"

smooth_weight_change_params: null

swap_fee: "0.002000000000000000"

total_shares:

amount: "18282469846754434906194"

denom: gamm/pool/1011

total_weight: "1073741824000000"

Let's say we want to migrate this into a CL pool where uosmo is the quote

asset and arb base unit is the base asset.

Note that quote asset is denom1 and base asset is denom0.

We want quote asset to be uosmo so that limit orders on ticks

have tick spacing in terms of uosmo as the quote.

Note:

- OSMO has precision of 6. 1 OSMO = 10**6

uosmo - ARB has precision of 18. 1 ARB = 10**18

arbbase unit

Therefore, the true price of the pool is:

>>> (218023341414 / 10**6) / (101170077995723619690981 / 10**18)

2.1550180224553714

However, in our core logic it is represented as:

218023341414 / 101170077995723619690981

2.1550180224553714e-12

or

osmosisd q gamm spot-price 1011 uosmo ibc/10E5E5B06D78FFBB61FD9F89209DEE5FD4446ED0550CBB8E3747DA79E10D9DC6

spot_price: "0.000000000002155018"

As a protocol, we need to accomodate prices that are very far apart.

In the example above, the difference between 10**6 and 10**18

Most of the native precision is 106. However, most of the ETH precision is 1018.

This starts to matter for assets such as upepe. That have

a precision of 18 and a very low price level relative to

the quote asset that has precision of 6 (e.g uosmo or uusdc).

The true price of PEPE in USDC terms is 0.0000009749.

In the "on-chain representation", this would be:

0.0000009749 * 10**6 / 10**18 = 9.749e-19

Note that this is below the minimum precision of sdk.Dec.

Additionally, there is a problem with tick to sqrt price conversions where at small price levels, two sqrt prices can map to the same tick.

As a workaround, we have decided to limit min spot price to 10^-12

and min tick to -108000000. It has been shown at at price levels

below 10^-12, this issue is most apparent. See this issue for details:

https://github.com/osmosis-labs/osmosis/issues/5550

Now, we have a problem that we cannot handle pairs where the quote asset has a precision of 6 and the base asset has a precision of 18.

Note that this is not a problem for pairs where the quote asset has a precision of 18 and the base asset has a precision of 6. E.g. OSMO/DAI.

Solution

At launch, pool creation is permissioned. Therefore, we can ensure correctness for the initial set of pools.

Long term, we will implement a wrapper contract around concentrated liquidity that will handle the precision issues and scale the prices to all have a precision of at most 12.

The contract will have to handle truncation and rounding to determine how to handle dust during this process. The truncated amount can be significant. That being said, this problem is out of scope for this document.

Terminology

We will use the following terms throughout the document and our codebase:

Tick- a unit that has a 1:1 mapping with priceBucket- an area between two initialized ticks.Tick Range- a general term to describe a concept with lower and upper bound.- Position is defined on a tick range.

- Bucket is defined on a tick range.

- A trader performs a swap over a tick range.

Tick Spacing- the distance between two ticks that can be initialized. This is what defines the minimum bucket size.

Note that ticks are defined inside buckets. Assume tick spacing is 100. A liquidity provider creates a position with amounts such that the current tick is 155 between ticks 100 and 200.

Note, that the current tick of 155 is defined inside the bucket over a range of 100 to 200.

Initialized Tick- a tick at which LPs can provide liquidity. Some ticks cannot be initialized due to tick spacing.MinCurrentTickis an exception due to being 1 tick belowMinInitializedTick. Only initialized ticks are crossed during a swap (see "Crossing Tick") for details.MinInitializedTick- the minimum tick at which a position can be initialized. When this tick is crossed, all liquidity is consumed at the tick ends up onMinCurrentTick. At that point, there is no liquidity and the pool is in no bucket. To enter the first bucket, a swap right must be done to cross the next initialized tick and kick in the liquidity. If at least one full range position is defined,MinInitializedTickwill be the first such tick.MinCurrentTick- is the minimum value that a current tick can take. If we consume all liquidity and cross the min initialized tick, our current tick will equal to MinInitializedTick - 1 (MinCurrentTick) with zero liquidity. However, note that thisMinCurrentTickcannot be crossed. If current tick equals to this tick, it is only possible to swap in the right (one for zero) direction.MaxTick

- is the maximum tick at which a position can be initialized. It is also the maximum value that a current tick can be. Note that this is different from theMinInitializedTickandMinCurrentTickdue to our definition of the full range (see below). The full range is inclusive of the lower tick but exclusive of the upper tick. As a result, we do not need to differentiate between the two for the max. When the pool is on theMaxTick, there is no liquidity. To kick in the liquidity, a swap left must be done to cross theMaxTick` and enter the last bucket (when sequencing from left to right).Initialized Range- the range of ticks that can be initialized:[MinInitializedTick, MaxTick]Full Range- the maximum range at which a position can be defined:[MinInitializedTick, MaxTick)Crossing Tick- crossing a tick means leaving one bucket and entering another. Each tick has a liquidity net value defined. This value measures "how much of liquidity needs to be added to the current when crossing a tick going left-to-right and entering a new bucket". This value is positive for lower ticks of a position and negative for higher. When going left-to-right, instead of adding, we subtract this value from the current liquidity. There are two edge cases. First, when pool crosses aMinInitializedTick, the pool does not enter any bucket. since it is now outside of theFull Range. Second, when pool crossed aMaxTick, the pool does not enter any bucket since it is now outside of theFull Range. Instead, we treat this being directly on either theMinCurrentTickorMaxTick.